SEC Announces New Disclosure Requirements: Pay versus Performance

September 14, 2022

By: Michael C. Donlon, Jessica M. Blanchette, Elizabeth L. Morgan

The Securities and Exchange Commission (SEC) has adopted final rules that will require new disclosures in proxy and information statements regarding the relationship between executive compensation paid by a company and the company’s financial performance. The Dodd-Frank Wall Street Reform and Consumer Protection Act, enacted in 2010, required the SEC to adopt regulations requiring public companies to disclose its “pay versus performance.” The SEC proposed rules in response to this mandate in 2015 but the comment period for the proposed rules was not reopened until January 2022, with final rules now adopted in August 2022. The final rules are available here.

Despite the passage of 12 years between the congressional rulemaking mandate and the adoption of the final rules, the time horizon to comply is short. The final rules will require significant new disclosures in 2023 proxy and information statements. The preparation of the new disclosures will require review and discussion among senior executive officers, members of the compensation committee and, if applicable, the company’s compensation consultants and outside legal counsel. Companies should begin the process of establishing the personnel and data sources required to comply with the final rules immediately.

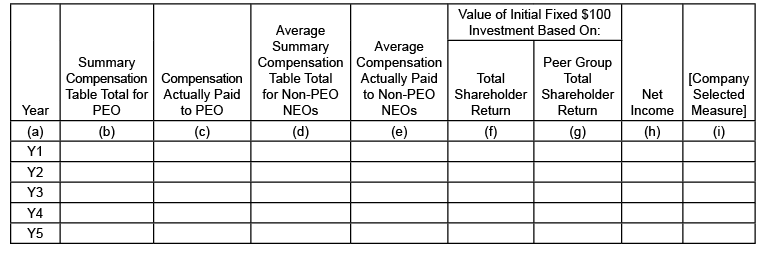

The final rules, which apply to registrants other than emerging growth companies, registered investment companies and foreign private issuers, include three new disclosure requirements. First, the final rules require a table that reports for each of the last five fiscal years[1] (i) the compensation of the company’s principal executive officer (PEO) and the average compensation of the company’s other named executive officers (NEOs), both as reported in the Summary Compensation Table and as actually paid, and (ii) certain financial performance measures. The table should look substantially like the following:

Second, the final rules require a description, using the information in the above table, of the relationships between the compensation actually paid to the PEO and the average compensation actually paid to the company’s other NEOs over the company’s five most recently completed fiscal years to each of the financial performance measures reported in the table. Third, the final rules require companies to provide an unranked list of at least three, and not more than seven, of the most important financial performance measures used by the company in linking executive compensation to company performance, from which the “Company-Selected Measure” in the above table must be selected.

The final rules allow companies to choose the method in which to convey these required descriptions—graphical, narrative or a combination—as long as the result is a clear conveyance of the material to investors. Moreover, companies may determine where in the proxy or information statement to provide the entire disclosure.

That said, the final rules do still require companies to comply with SEC Interactive XBRL rules when filing the new pay versus performance disclosures and do provide additional guidance on and requirements for key items such as which executives fall within the definitions of PEO and NEO, amounts factored into calculating compensation actually paid and average compensation figures, and acceptable measures of performance.

Lastly, the final rules contain scaled disclosure requirements for smaller reporting companies (SRCs). Consistent with an SRC’s existing scaled executive compensation disclosure requirements, an SRC’s pay versus performance disclosure requirements are modified as follows:

- SRCs can present three, instead of five, fiscal years of disclosure in the Pay Versus Performance Table.

- The transition period allows SRCs to provide two years of data, instead of three, in the first applicable filing after the final rules become effective.

- SRCs are not required to disclose amounts related to pensions for purposes of disclosing executive compensation actually paid.

- SRCs are not required to present peer group Total Shareholder Return (TSR).

- SRCs can omit the tabular list of the three to seven most important financial performance measures used by the company to link compensation actually paid for the most recently completed fiscal year to the company’s performance.

- SRCs are not required to provide disclosure in SEC Interactive XBRL format until the third filing in which the SRC provides pay versus performance disclosure.

The final rules will become effective Oct. 11, 2022 (30 days following publication of the release in the Federal Register). Companies must begin to comply with the new disclosure requirements in proxy and information statements that include executive compensation disclosures for fiscal years ending on or after Dec. 16, 2022.

The attorneys at Bond can assist you and your company in complying with these new disclosure requirements. Please contact Michael Donlon, or the attorney at the firm with whom you are regularly in contact.

[1] There is a transition period for companies subject to the new disclosure rules. Disclosure is initially required for three fiscal years, adding an additional year in each of the following two years so that the disclosure will cover five fiscal years when fully phased-in. There is a special transition period for smaller reporting companies discussed below.