Tax Assessment: Is Your School Board Struggling With New York's Real Property Tax Cap? Bond Can Help

February 1, 2012

On June 24, 2011, Governor Cuomo signed the property tax cap legislation into law (Chapter 97 of the Laws of 2011). The significant aspects of the tax cap legislation are: 1) the law caps increases to local government, school district, and special district levies; 2) the law details the formula each taxing entity must use to calculate its levy; 3) the law excludes limited expenditures; 4) the law contains override provisions; 5) the law accounts for and may encourage tax base growth; and 6) the law includes a "consequence" for levying more than is permissible.

Bond understands that this new law, the cap formula, its exclusions, override provisions, and especially its quick compliance deadlines can be overwhelming. Compounding the confusion, there are many guidance documents and other publications that appear authoritative and that purport to explain the law "in plain English," but that present conflicting opinions or facts. However, these guidance documents are no real substitute for the real-world application of this law to your specific District and your budgetary processes. Bond can help navigate this new law quickly and efficiently. Below are a few quick points about the law to consider.

The Law Caps Only the Levy

In its most simple terms, a district's levy is a function of three components: budget, property assessments, and tax rates. New York State's Legislature has opted not to cap increases to property tax assessments or tax rates. Rather, the law limits only increases in a district's levy.

The Tax Levy Growth Limit

A district's tax levy cannot increase beyond 2% of the prior year's levy or the rate of inflation as determined by the Consumer Price Index (the "CPI"), whichever is less. In no case will the allowable growth be less than a 1%. Each local government, special district, and school district will separately establish their own permissible levy under the levy growth limit each year each year. The CPI for local governments, special districts, and school districts will be 2% this year.

Specific Expenditure Exclusions

The following are the limited expenditure exclusions:

1. Tort Settlements and Judgments, for any amount exceeding 5% of the prior year's total tax levy.

2. Pension contribution increases of more than 2%, except that a district must still include in its levy calculations the amount necessary to fund any TRS annual increases in rates up to 2%.

3. "Bricks and mortar" growth to the tax base.

4. The levy necessary for capital expenditures (with debt service), for school districts only.

Overriding the Cap

For school districts, if a proposed budget imposes a tax levy increase equal to or less than the applicable tax levy growth limit, then only a majority vote (i.e., >50%) is required to adopt that budget. If, on the other hand, a proposed district budget, or, if any separate expenditure proposition will individually or collectively have the effect of exceeding the levy limit, then the budget must pass by 60% supermajority vote. In addition, if a district presents a budget that includes increase over the tax levy limit, the ballot must include language indicating that the budget requires a 60% vote to pass.

Excessive Levies

As the ink's barely dry on this law and we've yet to see guidance on a few elements of the law, errors in the implementation and interpretation of the law may occur. School districts must, of course, do their best to accurately calculate their levy limit under the cap using the prescribed formula. However, should an error occur, any property taxes collected in excess of the allowable limit must be placed in an interest-earning reserve fund. These reserves (plus interest) must then be used to offset the tax levy in the ensuing fiscal year. In such a case, a district's levy in the succeeding year can only be increased by the allowable growth levy amount over what the proper levy should have been in the prior year.

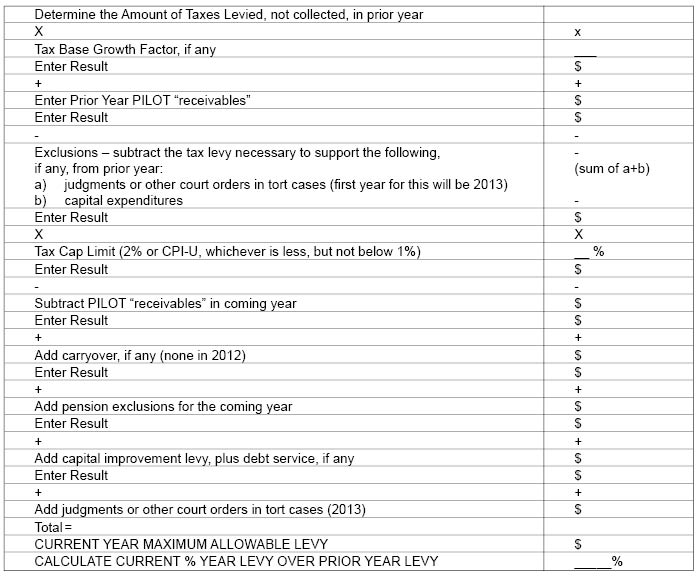

The Calculation Formula

If you have any further questions or concerns regarding the implementation or override of the property tax cap law, how this law affects your budget process, or what to expect if your District is audited, please contact Bond, Schoeneck & King, PLLC.

Central and Northern New York: call 315.218.8000 or e-mail:

| Kathleen M. Bennett | kbennett@bsk.com |

| Kevin M. Bernstein | kbernstein@bsk.com |

| Brody D. Smith | bsmith@bsk.com |

Buffalo and Southern Tier: call 716.566.2800 or e-mail:

| Stephen A. Sharkey | ssharkey@bsk.com |

Capital District: call 518.533.3000 or e-mail:

| Stuart F. Klein | sklein@bsk.com |

Rochester Region: call 585.362.4700